Minerva Surgical Reports Fourth Quarter and Full-Year 2021 Financial Results

IR News

Click here for PDF Version

March 8, 2022

SANTA CLARA, Calif., March 08, 2022 (GLOBE NEWSWIRE) -- Minerva Surgical, Inc. (Nasdaq: UTRS) (Minerva Surgical or the Company), a woman's health company focused on the treatment of Abnormal Uterine Bleeding (AUB), today reported fourth quarter and full-year financial results for the period ended December 31, 2021.

Fourth Quarter and Business Highlights:

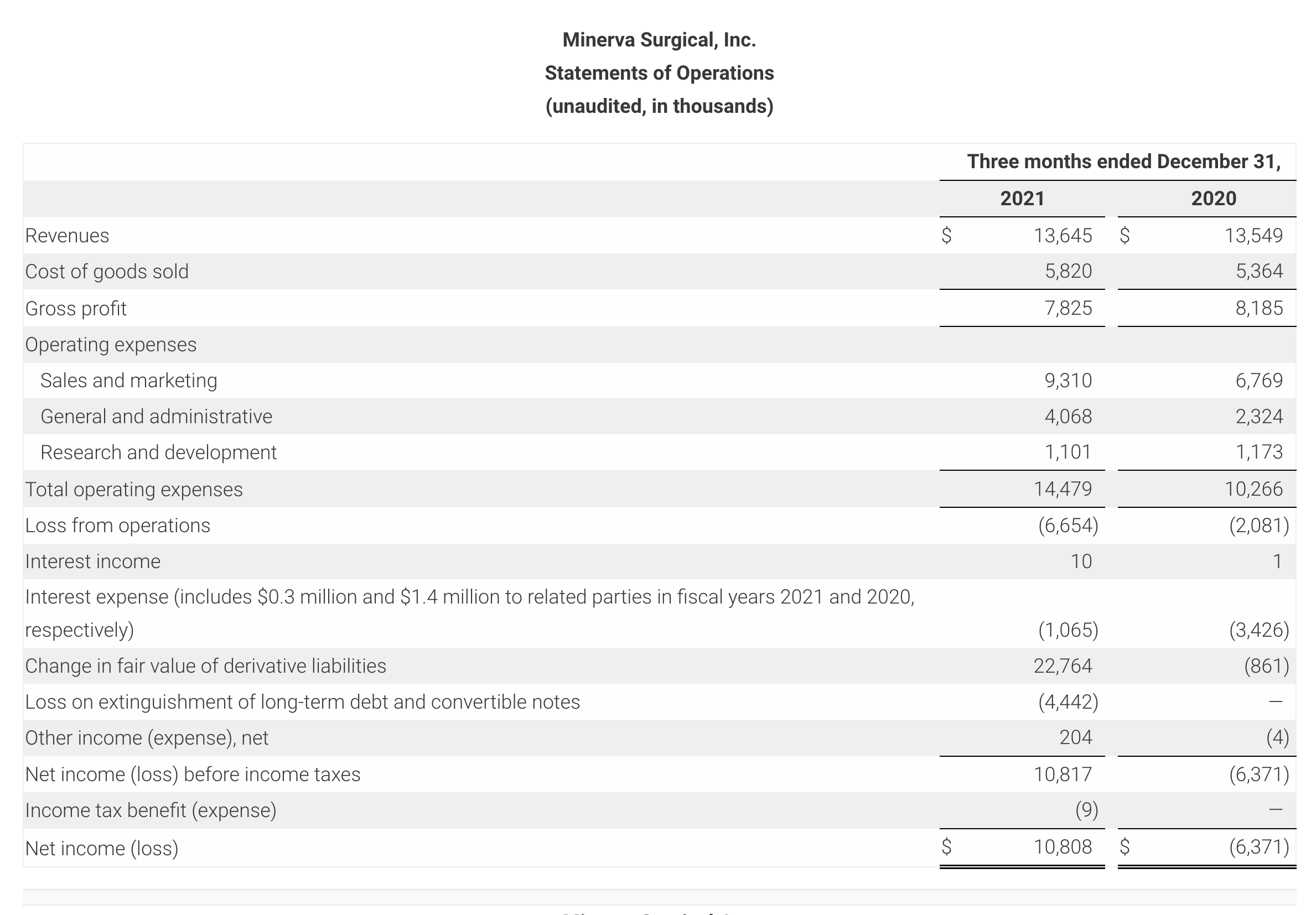

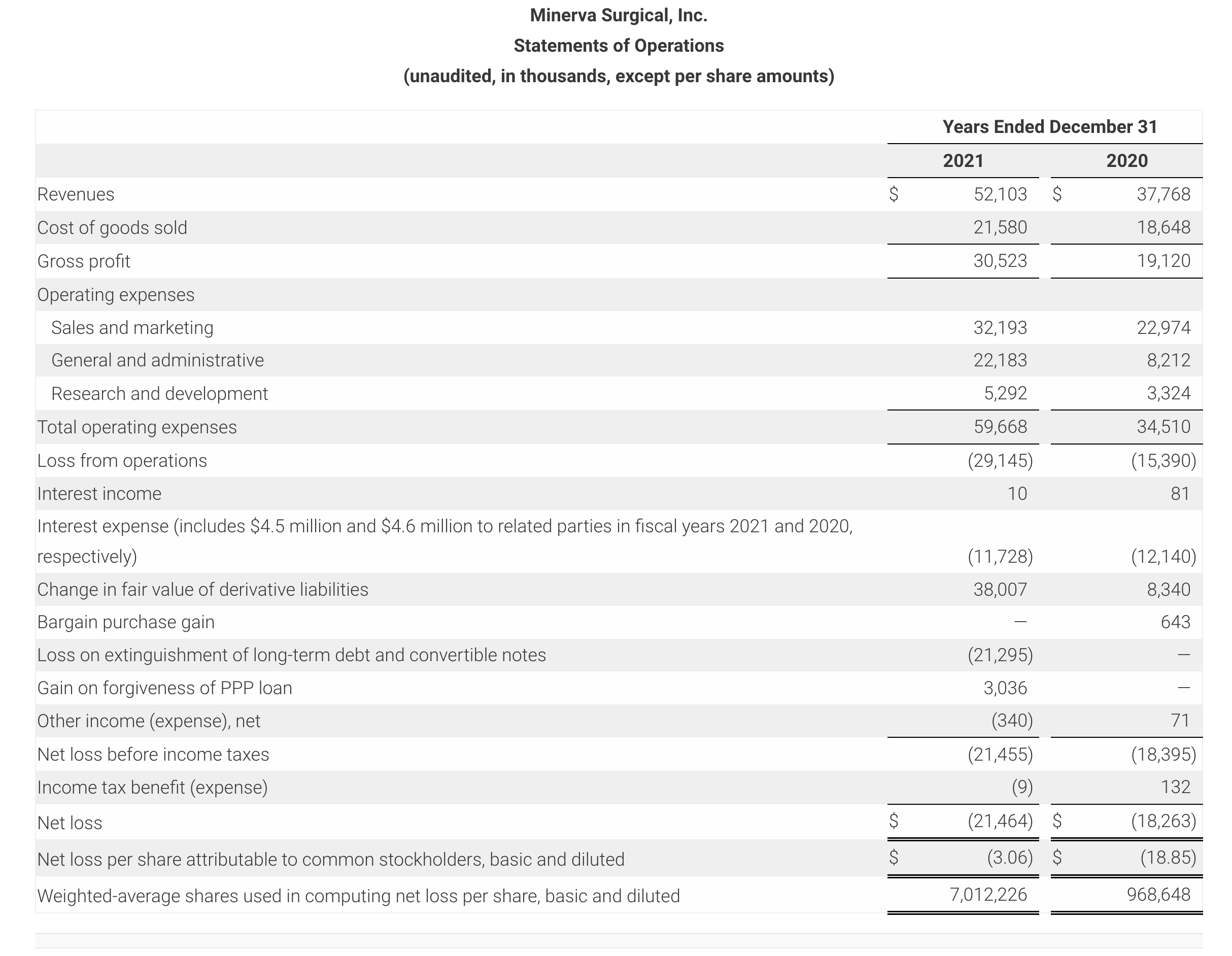

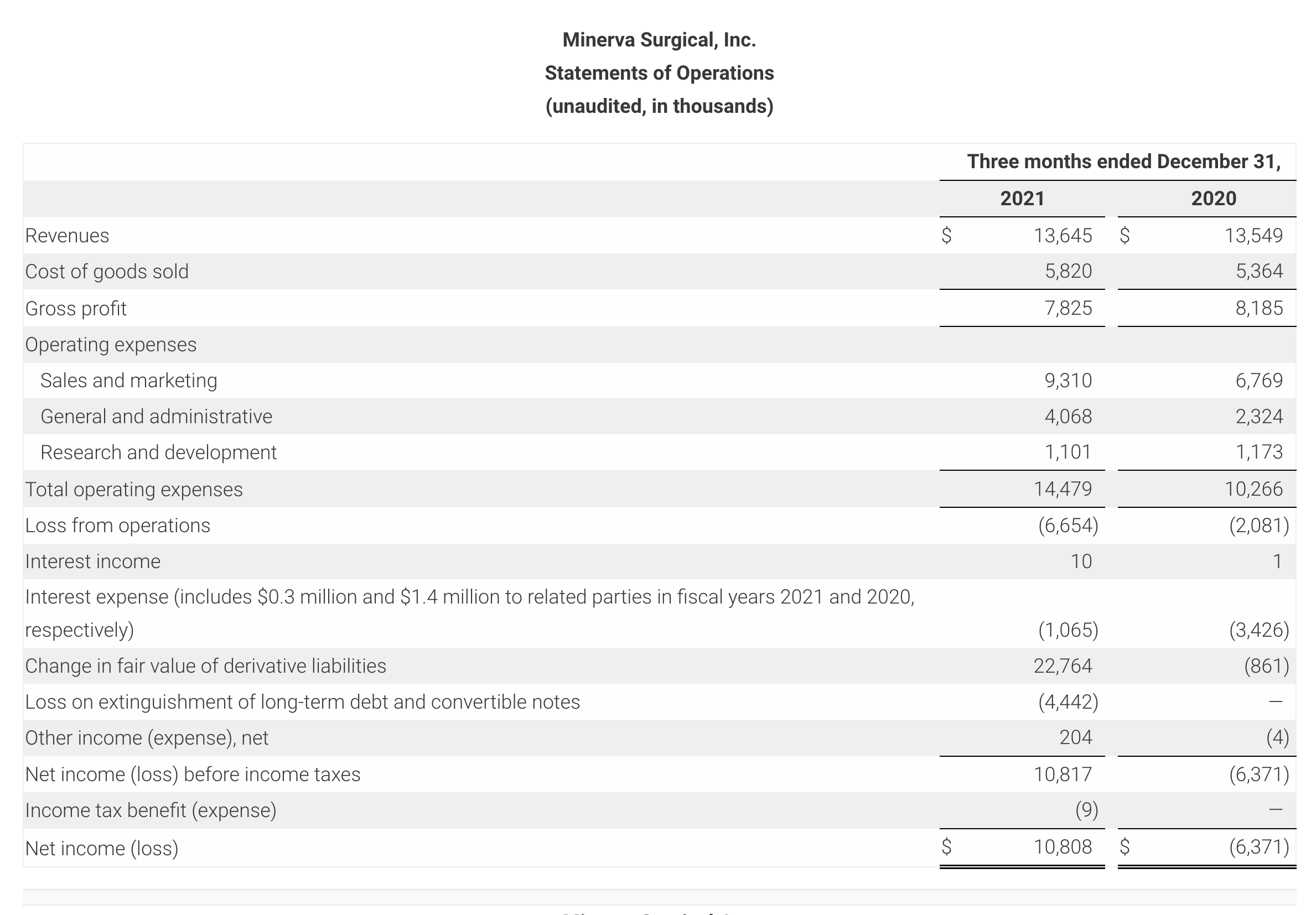

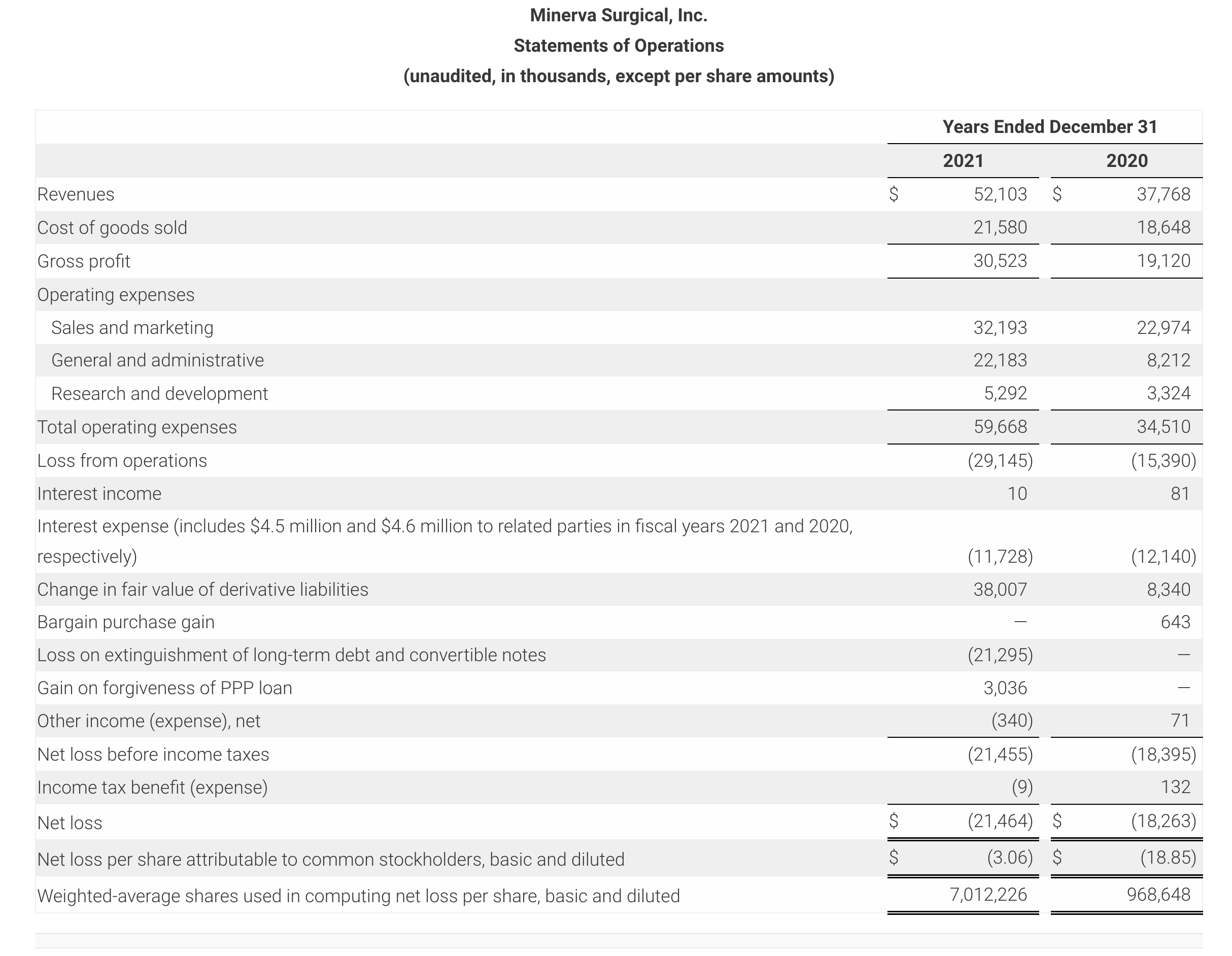

- Reported revenue of $13.65 million in the fourth quarter of 2021, compared with revenue of $13.55 million in the fourth quarter of 2020, a nominal increase over the prior period.

- Expanded contract coverage in 2021 to broaden commercial opportunity in approximately 500 hospitals.

- Drove first time orders with 285 new hospital customers in 2021.

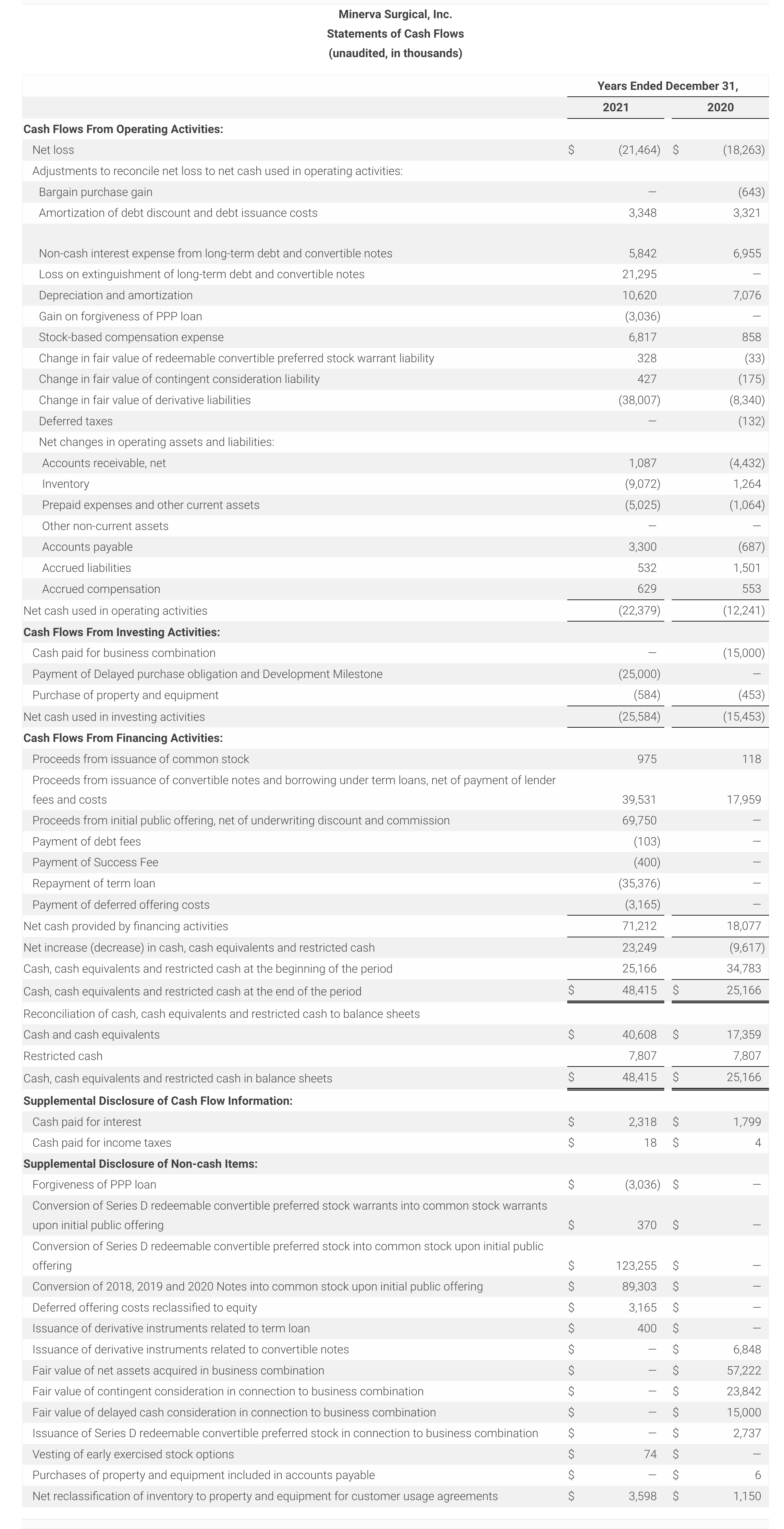

- Refinanced existing long-term debt facility with a new $40 million, five-year term loan from CIBC, substantially reducing the Company’s cost of debt capital.

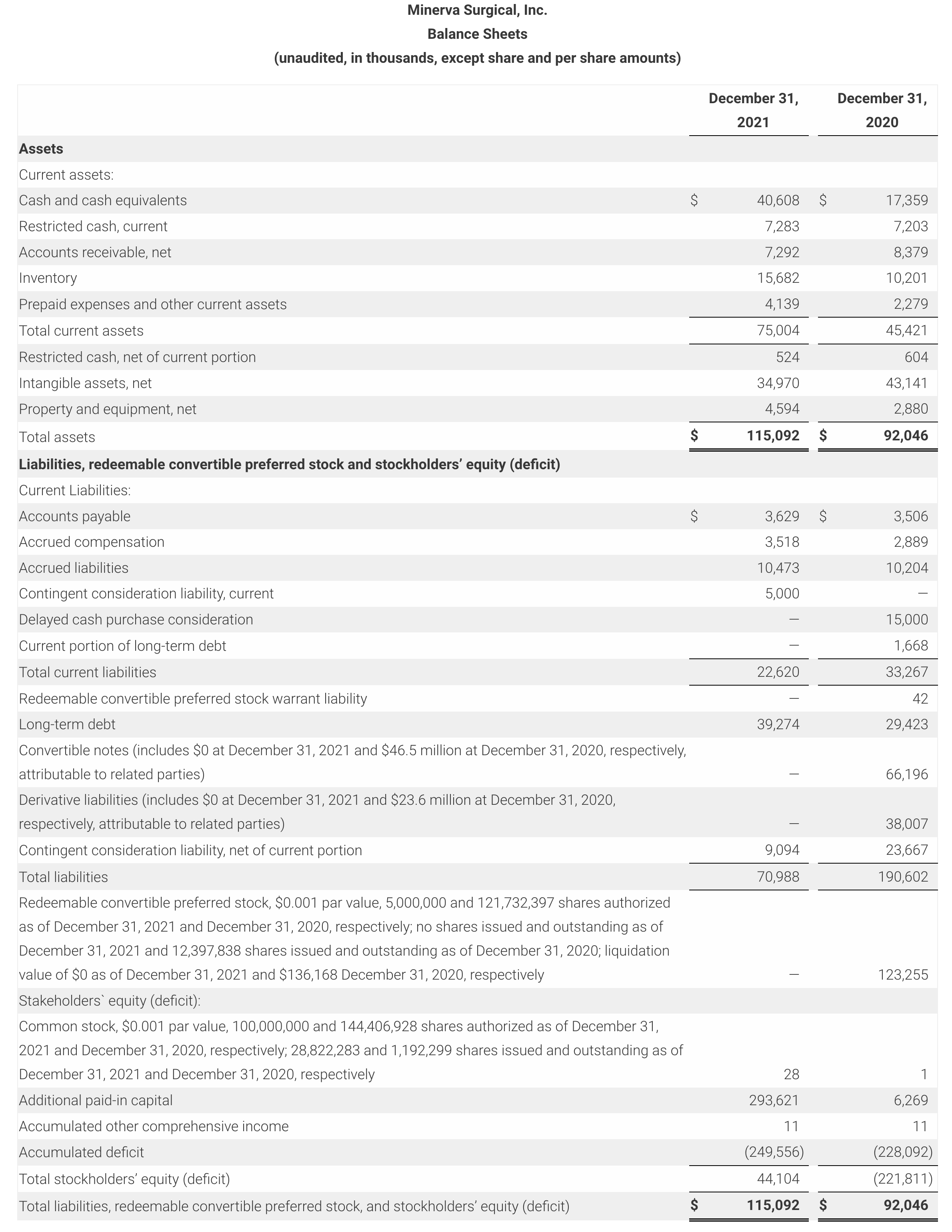

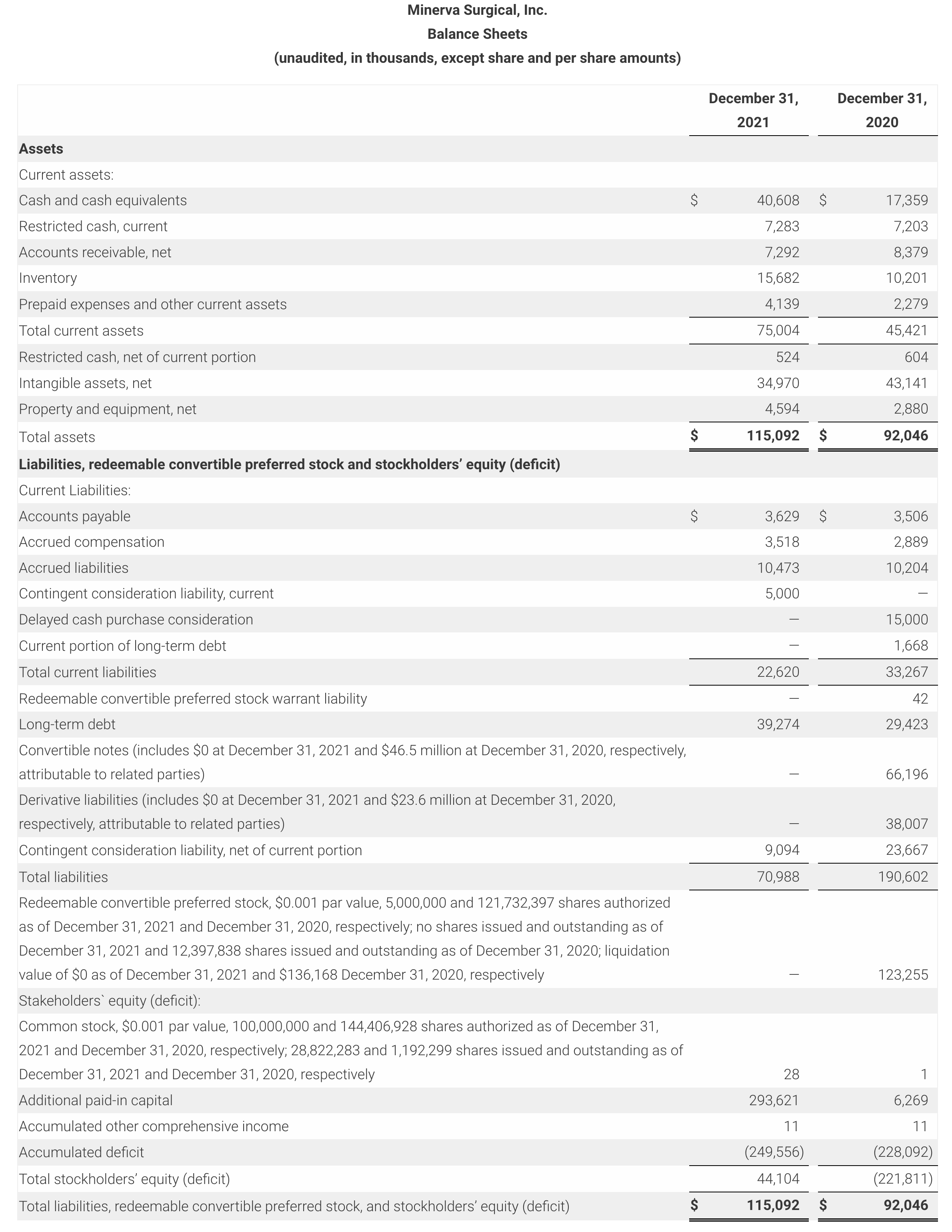

- Ended the fourth quarter with over $40 million in unrestricted cash and cash equivalents, reflecting the proceeds from the Company’s initial public offering completed on October 26, 2021.